Capital Markets 2020 -pwc

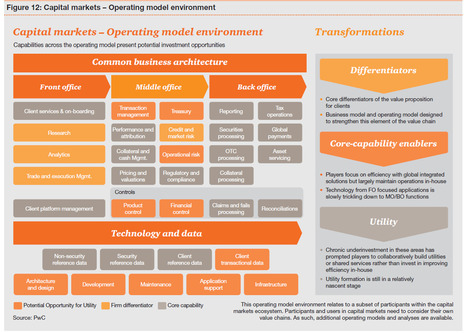

Cost reduction opportunities and pressure to stay aheda of market trends will force capital markets players to stretch towards new partnerships in order to look for efficiencies from third party services.

Technology and Regulation impact On Investment Banks

Regulatory reforms and technological advances in particular are challenging traditional capital markets (CM) participant models.

On one side, regulatory reforms are:

- Creating a balloon effect, risk when squeezed or reduced in one sector of the capital markets ecosystem, will emerge in another. Risk taking and capital facilitation will increasingly move into the shadow banking system (such as crowd funders and peer-to-peer lenders) challenging thus investment banks business model.

- Rising the cost of capital is pushing banks to cut costs and to review their business model.

Banks might expect the following scenario:

- As margins tighten, revenues will fall. Since operating costs are tied to volumes, not revenues, and since the revenue decline is driven mostly by price erosion, the full effect of lost revenue hits the bottom line nearly dollar-for-dollar.

- Capital requirements are also tied to volumes, not revenues, meaning they will not decline.

This means that banks can only keep ROE constant by significantly lowering their CIR, well below current levels.

- For a top-10 dealer, we estimate that 6 to 12 percent of revenues will be at risk in the next 5 years. (based on Mc Kinsey analysis)

Simplification, standardization, and digitization will likely be the only sizable avenues left for:

- keeping customers through a better customer experience

- substantial cost savings through operational excellence

Use Technology as a tool to create competitive advantages as well as to facilitate operational and regulatory changes.

Your new post is loading...

Your new post is loading...