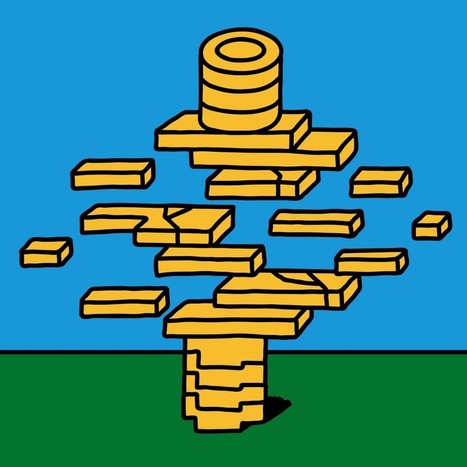

A Cornell University study of the system that powers Bitcoin concludes that it cannot become widely used without a major redesign: "The researchers estimate that Bitcoin’s current design could bear at most only about 27 transactions per second, using a block size of four megabytes, without forcing a significant cut in the number of computers powering the currency, making it more centralized. There is general agreement in the Bitcoin community that the system must remain decentralized to prevent the possibility of any company or government controlling the currency.“That’s still a fairly limited throughput,” says Emin Gün Sirer, an associate professor at Cornell who worked on the study. “If you compare it to what a big network like Visa is capable of [or] these imagined futures where computers are paying each other, it’s nowhere in the same vicinity.”Some people believe that Bitcoin can be useful without operating at vast scale, for example functioning as a gold-like asset generally held for long periods. But some of the biggest Bitcoin companies are built on the idea that Bitcoin will come to support a very large transaction volume.Brian Armstrong, CEO and cofounder of Coinbase, which helps people buy, sell, and use Bitcoins and has raised over $100 million, says he believes the currency will become widely used as a means of payment, particularly in the developing world.A company called 21 Inc has raised $121 million from investors, including the networking company Cisco, and says that very small “microtransactions” paid in Bitcoin will become an economic backbone used by people and companies to pay for services and goods such as Wi-Fi, data analysis, or music.Joi Ito, director of the MIT Media Lab, which supports three leading developers of Bitcoin’s code, says that he believes the people working on the currency will be able to find ways it can scale up. But it may not be possible to upgrade Bitcoin’s capacity fast enough to meet the expectations of some investors and the Bitcoin companies they have backed, he says. “I think there are some businesses that have promised returns based on the scaling that are not really reasonable,” says Ito. Ito is a member of MIT Technology Review’s board."

|

Rescooped by Philippe J DEWOST from Consensus Décentralisé - Blockchains - Smart Contracts - Decentralized Consensus |

Philippe J DEWOST's curator insight,

February 16, 2016 9:04 AM

Very interesting article that should urge us to explore together instead of stating any definite truth about Bitcoin and Blockchain. Please read before reacting...

Sign up to comment

Your new post is loading...

Your new post is loading...

7 transactions/s means 220 million per year. Pushing the envelope to the theoretically mentioned 27 transactions/s would allow to reach over 850 million per year. Which, as pointed by @smetsjp , won't be enough to handle the needs for the Chinese or the European population.

Has anybody found a theoretical limit to the Blockchain TPS capabilities as a single distributed transactional system/space ?