Your new post is loading...

Your new post is loading...

Il a fallu 4 ans à l'Autorité de la concurrence pour condamner le Cartel des titres-restaurant, saisie par la startup RESTO FLASH : La French Tech est aussi une histoire de résilience ! Cet exemple illustre parfaitement les pratiques - dignes du siècle dernier - d'un secteur qui embrasse sa transformation digitale par le refus et le déni, et le rôle clé du régulateur qui protège et encourage les plus agiles et les plus fragiles. Pourtant, investir une fraction de cette somme dans l'entreprise, aux côtés de Pierre Kosciusko-Morizet ou Olivier Mathiot, aurait permis à l'un de ces acteurs de prendre de vitesse tous les autres. Les voici désormais englués dans le passé tandis que plusieurs startups ont emboité le pas à l'équipe d'Emmanuel Rodriguez-Maroto pour révolutionner le marché à la suite de RESTO FLASH.

Japan’s SoftBank has radically scaled back plans for fresh investment in WeWork, the loss-making, shared-office provider, following the recent tech stock rout and concerns among investors in its $100 billion Vision Fund. SoftBank is in detailed negotiations to inject $2bn into WeWork this year, according to two people briefed on the deal, a much lower amount than the $16 billion that had been discussed towards the end of last year. And the deal will now not include the participation of Softbank’s Vision Fund, which had been a major backer of Softbank’s existing investment of more than $8 billion in WeWork. The funding could be announced as soon as this week, according to one of the people, who added that the deal had not yet been agreed and could still fall apart. The scaling-back of the planned $16bn investment, which would have been the largest ever in a tech start-up, underlines the rapid shift in investor enthusiasm for technology shares that is now spilling into even the best-known privately held groups. SoftBank has been instrumental in propping up private market valuations, investing billions of dollars in start-ups from ride-hailing group Uber to dog-walking app Wag. WeWork has been one of the company’s largest bets, garnering billions from SoftBank as the group sought to dominate the fast-growing market for shared office space in cities such as New York and London even as its own losses have ballooned. The negotiations over fresh funding have taken place against a backdrop of a sharp sell-off in equity markets that saw some of the world’s largest technology companies particularly hard hit in recent months. Shares in SoftBank itself have fallen by 33 per cent in the past three months. The company also suffered an embarrassing start to trading for its newly-listed Japanese mobile phone business in late December after raising $23 billion from investors. SoftBank will not gain a majority stake in the shared-office provider, which has become known for specialist coffees and fruit-infused water in its canteens and Instagram-ready art on its walls. WeWork and SoftBank declined to comment. If a deal is finalised, SoftBank will still have pumped more than $10bn into the company, marking one of the biggest bets on a start-up by SoftBank founder Masayoshi Son.

One flying car seems absurd; Larry Page has three. He started with Cora, a two-seater flying taxi, then added a sporty flying boat called Flyer, both developed by a company called Kitty Hawk. And last week, The Vergediscovered a third: Opener, which just came out of stealth mode. There was no mention of the Google co-founder in the startup’s announcement, but when confronted with evidence of Page’s involvement, Opener quickly issued a press release admitting it. Flying cars (more formally known as eVTOLs — for electric vertical takeoff and landing) are the electric scooters of aviation. Everyone from Uber to Airbus is working to build the lightweight aircraft and the aerial networks they will require, to say nothing of a host of well-funded startups, including Joby in the US, Volocopter in Germany, and China’s EHang. Page is making his flying car companies compete for attention and funding Kitty Hawk and Opener are based just a few buildings away from each other in Palo Alto, California, but have almost no contact. In fact, their CEOs have to compete for Page’s attention and funding, according to multiple sources close to the companies. Workers at Kitty Hawk and Opener don’t know whether Page is simply hedging his bets with multiple aircraft, or embarking on a bold attempt to corner the market for flying cars as it emerges. The reason for multiple companies may be even more prosaic: the leaders of each project reportedly can’t stand each other. Regardless, Page now controls three of the world’s most advanced flying car projects, ahead of rivals like Joby, Uber, and aerospace giant Airbus, whose vehicles remain largely experimental.

When a magazine challenged a technology company to use AI to pick 50 unheard of companies that were set to flourish, the experiment yielded dramatic results. In 2009, Ira Sager of Businessweek magazine set a challenge for Quid AI's CEO Bob Goodson: programme a computer to pick 50 unheard of companies that are set to rock the world. The domain of picking “start-up winners” was - and largely still is - dominated by a belief held by the venture capital (VC) industry that machines do not play a role in the identification of winners. Ironically, the VC world, having fuelled the creation of computing, is one of the last areas of business to introduce computing to decision-making. Nearly eight years later, the magazine revisited the list to see how “Goodson plus the machine” had performed. The results surprised even Goodson: Evernote, Spotify, Etsy, Zynga, Palantir, Cloudera, OPOWER – the list goes on. The list featured not only names widely known to the public and leaders of industries, but also high performers such as Ibibo, which had eight employees in 2009 when selected and now has $2 billion annual sales as the top hotel booking site in India. Twenty percent of the companies chosen had reached billion-dollar valuations. To contextualize these results, Bloomberg Businessweek turned to one of the leading “fund of funds” in the US, which has been investing in VC funds since the 1980s and has one of the richest data sets available on actual company performance and for benchmarking VC portfolio performance. The fund of funds was not named for compliance reasons, but its research showed that, had the 50 companies been a VC portfolio, it would have been the second-best-performing fund of all time. Only one fund has ever chosen better, which did most of its investments in the late 1990s and rode the dotcom bubble successfully. Of course, in this hypothetical portfolio, one could choose any company, whereas VCs often need to compete to invest.

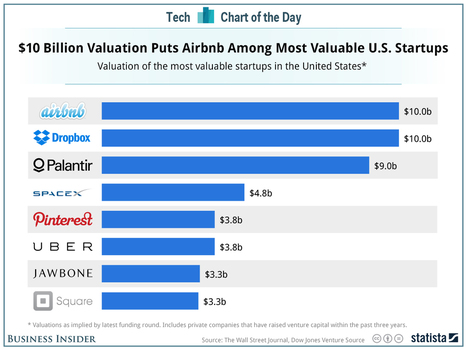

Airbnb is reportedly in talks to get new funding at a $10 billion valuation. That would vault Airbnb to the top of the startup valuation rankings

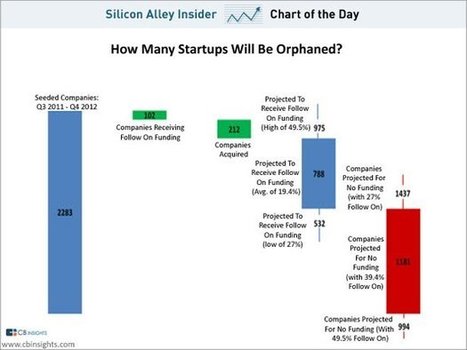

The so-called Series A crunch isn't the problem.

Avec l'entrée en Bourse de Facebook, et sa capitalisation supérieure à $100bn, une question est sur toutes les lèvres : « à quand un Facebook français ? ». La réponse est simple: ce n’est pas pour demain, voire même jamais si nous ne créons pas vite un écosystème favorable.

Belle analyse de Jean-David CHAMBOREDON, toujours aussi pertinent...

|

McDonald’s is increasingly looking at tech acquisitions as a way to reinvent the fast-food experience. Today, it’s announcing that it’s buying Apprente, a startup building conversational agents that can automate voice-based ordering in multiple languages. If that sounds like a good fit for fast-food drive thru, that’s exactly what McDonald’s leadership has in mind. In fact, the company has already been testing Apprente’s technology in select locations, creating voice-activated drive-thrus (along with robot fryers) that it said will offer “faster, simpler and more accurate order taking.” McDonald’s said the technology also could be used in mobile and kiosk ordering. Presumably, besides lowering wait times, this could allow restaurants to operate with smaller staffs. Earlier this year, McDonald’s acquired online personalization startup Dynamic Yield for more than $300 million, with the goal of creating a drive-thru experience that’s customized based on things like weather and restaurant traffic. It also invested in mobile app company Plexure. Now the company is looking to double down on its tech investments by creating a new Silicon Valley-based group called McD Tech Labs, with the Apprente team becoming the group’s founding members, and Apprente co-founder Itamar Arel becoming vice president of McD Tech Labs. McDonald’s said it will expand the team by hiring more engineers, data scientists and other tech experts.

L’ouverture d’un tiers lieu par un grand groupe est considérée au mieux comme un non-événement, au pire comme une simple posture d’innovation. Pourquoi ? D’abord parce qu’on assiste à la profusion de tels endroits, mais aussi parce que ce mot « lieu » s’est comme appauvri de sa signification (état des lieux, esprit des lieux, lieu du crime, …), à tel point qu’il soit besoin de le réhausser d’un préfixe — qui plus est divisif : un tiers-lieu, est-ce un demi-lieu en encore plus petit ?

Historically, startups have been the engine of US economy. By creating new jobs and surfacing new ideas, startups play an outsized role in making the economy grow. It’s too bad they are a dying breed. While companies that were less than two years old made up about 13% of all companies in 1985, they only accounted for 8% in 2014. A far smaller share of people work for startups From around 1998 to 2010, the share of private sector workers in companies that were less than two years old plummeted from more than 9% to less than 5%. The startup decline is happening across the economy A new report from the Brookings Institution, finds that in nearly every industry, from agriculture to finance, the share of new companies is falling. So what’s going on? It’s not entirely clear, but the authors of the Brookings report have some ideas. One possibility: Startups are struggling in this era of rising market concentration. In most industries, since the 1980s, the share of all sales going to the top firms is increasing. Startups may have a hard time competing with these mega firms, which can out pay them for the best talent and sometimes attempt to drive them out of the industry. Previous Brookings research found there are fewer startups in states where a smaller number of companies dominate the market (pdf). Another related possibility is that the most-educated American workers are no longer attracted to entrepreneurship. In 1992, 4% of 25-54 year olds with a master’s degree or PhD owned a small company with at least 10 employees. In 2017, this was true of only 2.2%. Companies started by the highly educated are often unusually productive. The Brookings report suggests that high salaries for educated employees at big companies have made entrepreneurship less compelling. Why compete with Google or Walmart when they are offering you an enormous amount of money to come work for them?

U.S. startups have traditionally had access to far higher levels of investment, giving them a head start when it comes to research and development and making it easier to attract to its shores the very best talent. Yet the arms race is becoming closer. According to Dow-Jones VentureSource, the second quarter of 2014 saw over €2.1 billion ($2.4 billion at the current conversion rate) raised by European startups — the highest quarterly total since 2001. (For comparison’s sake, the figure for U.S.-based startups in that period was $13.8 billion.) Encouraged by the success of European tech firms such as Shazam and Transferwise — both of which made valuations of billion dollars in early 2015 — more U.S. money is crossing the pond. There is also an increasing confidence in investors that Europe has the talent pool to thrive, and there has not been an irreparable “brain drain” to Silicon Valley.

When the Jobs Act became law in April, supporters proclaimed a new era for small businesses seeking to raise money. The “game changer,” as President Obama put it in the Rose Garden as he signed the bill, was a provision to let small companies “crowdfund” — that is, sell stock and other securities over the Internet directly to the public. “For the first time,” the president said, “ordinary Americans will be able to go online and invest in entrepreneurs that they believe in.” But it now seems that dawn will break late on this new age of democratic investing. The Securities and Exchange Commission appears certain to miss its end-of-year deadline for issuing regulations to put the provision into effect. And with the departure of the S.E.C. chairwoman, Mary L. Schapiro, and three of her top deputies — including two who manage the offices writing the regulations — some in the nascent equity crowdfunding industry worry that it could be 2014 before their line of business becomes legal.

Every VC firm has its own way of evaluating potential investments. Remmy Oxley, an anonymous VC, says that Moneyball-style methods are the next step, and reveals his firm's algorithm for screening candidates.

|

Your new post is loading...

Your new post is loading...

Your new post is loading...

Your new post is loading...

Et le feuilleton est loin d'être terminé : http://decouverte.challenges.fr/entreprise/titres-restaurant-nouvelle-enquete-de-l-autorite-de-la-concurrence_700579