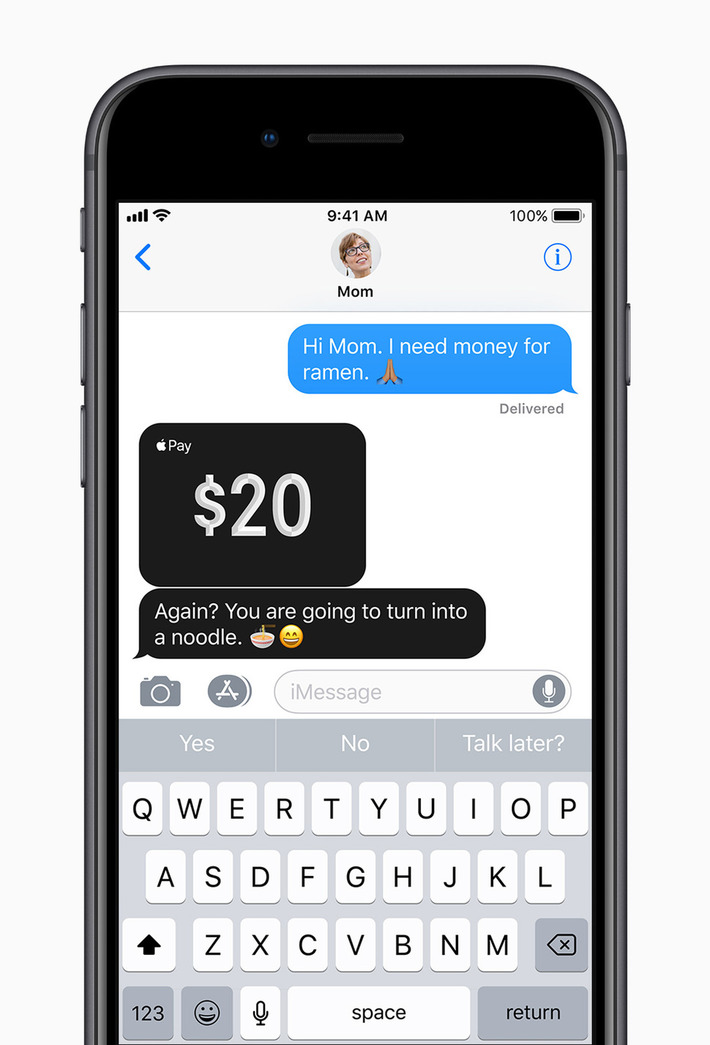

Apple has offered to let rivals access its tap-and-go mobile payments systems used for mobile wallets, three people familiar with the matter said, a move that could settle EU antitrust charges and stave off a possible hefty fine.

Research and publish the best content.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Already have an account: Login

The Payments ecosystem is evolving at an unprecedented pace driven by mobile, cloud computing, start-up's challenging the behemoths, and new technologies. My personal collection of curated stories and blogs.

Curated by

Vineet Anand

Your new post is loading... Your new post is loading...

Denisa Zichackova's curator insight,

March 30, 2016 5:53 AM

Andriod Pay preps for UK market where Andriod has 54% of market. UK consumers are high contactless uses and a transition to Andriod Pay will be a lot faster than experiences in US. Barclays continues to steer away from other Pay solutions in favor of its own! |

Curated by Vineet Anand

Payment Industry leader passionate about Fintech, Innovation in Banking, Product Management & Strategy, driving revenue growth through client management, business development and P&L focus.

Other Topics

Leadership & Communication

Payments Ecosystem

The Payments ecosystem is evolving at an unprecedented pace driven by mobile, cloud computing, start-up's challenging the behemoths, and new technologies. My personal collection of curated stories and blogs.

Social Media Marketing

World Economy News

|

A game changer for Apple Pay rivals that have for nearly a decade have been pushing Apple to open its tap-and-go services for inclusion. Players from down under Australia to US to EU have long challenged Apple for its inclusion of other rival providers. And whilst the current proprietary network has served well in building leadership, this change will change the landscape significantly.

Apple can benefit by driving greater revenue in opening it services post this EU offer conclusion by 1. charging a fee to use the service; and 2. through increased transaction volume; and 3. having users of rival players to likely convert to more Apple financial services offerings .. draw more consumers that benefits the larger Apple ecosystem.